All News

All News

U.S. President Biden and House Republican Speaker McCarthy announced on the evening of the 27th that they had reached a preliminary agreement on the federal government's debt ceiling and budget, and they are expected to submit the text of the agreement to Congress for voting soon. According to US media reports, although the two parties have initially reached an agreement, they still face challenges in completing the legislative process as scheduled due to differences of opinion. Moreover, the huge debt scale has become a huge hidden danger to the US economy.

U.S. Treasury Secretary Yellen previously postponed the earliest date for the U.S. government to default on its debt from June 1 to June 5, which was previously estimated. She said that if Congress does not raise or suspend the debt ceiling, it is estimated that by June 5, the Treasury Department will not have enough funds to meet payment obligations.

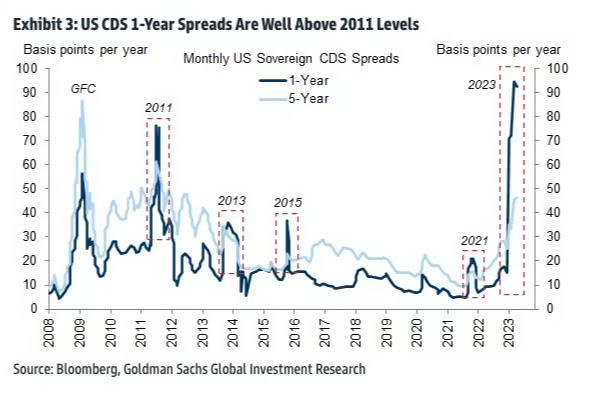

If the U.S. technically defaults, even for just a few days, it could push up interest rates and weaken market confidence in the dollar. On the 24th, the rating agency Fitch lowered the outlook on the US sovereign credit rating to "negative", arguing that the stalemate in the debt ceiling negotiations has brought greater downgrade risks to the US sovereign credit rating. DBRS Morningstar also put the United States on watch for a possible downgrade.

Moody's said that in mid-June, the United States will pay interest on national debt to maintain its highest AAA rating. On June 15, the U.S. Treasury is due to pay about $2 billion in interest. The IMF's preliminary annual assessment of the U.S. also believes brinkmanship around the federal debt ceiling could pose further systemic risks to the U.S. and global economies.

From a historical point of view, although there have been short-term government shutdowns in the United States, they still ended in an agreement between the two parties. This time, while international people including the International Monetary Fund called for avoiding the US debt default from affecting the global economy, they were relatively optimistic about reaching an agreement.

If it is said that before the 1980s when the debt issue was not sensitive, the government and Congress discussed the issue of the US debt ceiling was only a routine matter; then, as the budget deficit soared and the US domestic ideas and policies became more and more obvious, the debt ceiling issue increasingly prominent.

The battle over the debt ceiling has increasingly become a bargaining chip between the two parties. Compromises are always reached after the battles, and the next round of battles is prepared after the compromises. This has increasingly deviated from the original intention of setting the debt ceiling. This "political game" snowballed the US debt, causing the "gray rhinoceros" of high debt to grow bigger and bigger. Since 2001, the US debt ceiling has been raised once a year on average.

From the perspective of debt scale, the US debt has grown wildly, and the ceiling level is no longer what it used to be. In 1917, out of the need of the legislature to constrain the debt of the executive, the United States arranged the debt ceiling. The debt ceiling at the time was $11.5 billion. However, this upper limit is useless and has been continuously raised, and its proportion in GDP has also continued to rise.

Especially after the outbreak of the international financial crisis in 2008, the growth rate of U.S. debt was astonishingly fast: in the three years from 2008 to 2010, the U.S. national debt limit reached 10.61 trillion U.S. dollars, 12.10 trillion U.S. dollars and 14.29 trillion U.S. dollars, accounting for 1.5% of GDP. The proportions are 70%, 84.1% and 98% respectively.

After the outbreak of the COVID-19 pandemic, US debt has accelerated along with inflation. At present, the U.S. debt ceiling has reached 31.4 trillion U.S. dollars, an expansion of more than 2,700 times compared to 11.5 billion U.S. dollars in 1917. At the end of 2020, the ratio of US government debt to GDP has reached more than 129%. To make matters worse, the annualized cost of servicing this debt has risen by 90% compared with 2011, driven by rising debt and higher interest rates.

The huge debt scale has become the "confidant worry" of the United States. Even when the U.S. economy is recovering, it is difficult for the U.S. debt ratio to drop. Moreover, US debt is very dependent on the support of international investors, which in turn has become an implicit burden on countries. As the debt balloon continues to inflate, it is actually less safe for countries. Once the US economy is in danger, the whole world must pay for it. Holding U.S. debt is tantamount to holding a "safety bomb."